are car loan interest payments tax deductible

Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. File With Confidence Today.

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

If certain conditions are met you can deduct some or all of the interest payments you make on your car loan from your federal taxes.

. If you are not then you will not be able to claim any tax relief on car loan payments. If on the other hand the car is used entirely for business purposes the full amount of. The first question you need to answer is whether or not you are self-employed.

But you can deduct these costs from your income tax if its a business car. If youre claiming 50 percent business use for taxes your deduction would be 1250that is 50 of the loan interest amount. You actually should be able to.

The interest on a car title loan is not generally tax deductible. Interest paid on personal loans is not tax deductible. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

Read on for details on how to deduct car loan interest on your tax return. Interest on car loans may be deductible if you use the car to help you earn income. While you cannot deduct the 1500 payments you make on the principal loan amount you can deduct the 500 a month you pay in interest.

The interest accrued on this loan may be tax-deductible depending on what you use the funds for. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit.

The vehicle is subject to multiple purposes. However if the vehicle was used for a business purpose you may be able to deduct some or all of the cost against your self-employment income. You would also have to claim actual vehicle expenses rather than the standard mileage rate for your vehicle expenses.

The expense method or the standard mileage deduction when you file your taxes. The answer to is car loan interest tax deductible is normally no. The same is valid for interest payments on your business credit card business line of credit business car loan or any loan youre taking out exclusively for a business expense.

You dont necessarily need to run a large business either. Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. Types of interest not deductible include personal interest such as.

You must report your tax-deductible interest to the IRS and this invariably. But there is one exception to this rule. Interest paid on personal loans car loans and credit cards is generally not tax deductible.

Should you use your car for work and youre an employee you cant write off any of. Unfortunately car loan interest isnt deductible for all taxpayers. While traditional loans may offer benefits such as tax-deductible interest personal loans do not have that benefit.

Answered on Dec 03 2021. Interest on vehicle loans is not deductible in and of itself. Answer Simple Questions About Your Life And We Do The Rest.

But you cant just subtract this interest from your earnings and pay tax on the remaining amount. You can only use a loan as tax-deductible if the vehicle is for a business. Heres an example.

There are many costs associated with forming or running a business and you may need to take out a loan to cover them. You could qualify even if you have a side gig as a freelancer or consultant. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

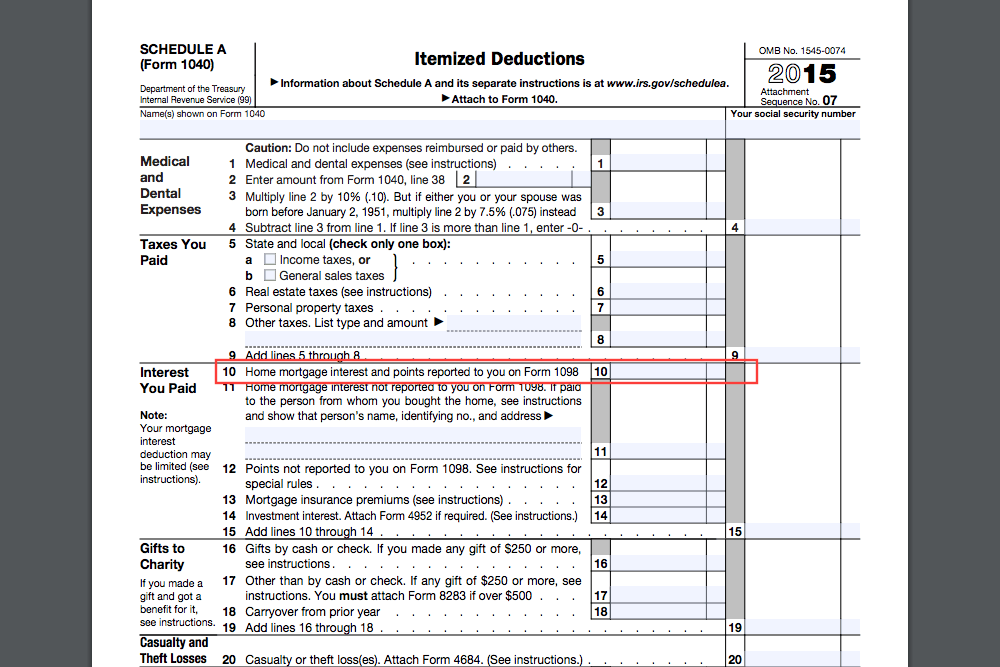

If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay 12. You can deduct the interest paid on an auto loan as a business expense using one of two methods. It can also be a vehicle you use for both personal and business purposes but you need to account for the usage.

Personal credit card interest auto loan interest and other types of personal consumer. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. Interest paid on a loan to purchase a car for personal use.

If you use your car for business purposes you may be able to deduct actual vehicle expenses. More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of factors. Typically deducting car loan interest is not allowed.

As a general matter personal loans do not carry deductible interest whether they are installment loans or lines of credit. Some of the expenses you may get a tax rebate for include operational expenses like fuel and oil repairs and servicing lease payments insurance premiums registration and depreciation. However there are exceptions to that rule ie a business owner who takes out a personal loan to invest in the enterprise.

You might pay at least one type of interest thats tax-deductible. On a chattel mortgage like. Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income.

13 Factors That Affect Car Insurance Rates Car Insurance Car Insurance Rates Insurance Is Buying A Car Tax Deductible In 2022 This Time There Is Lots Of Auto. This goes to the nature of an automobile loan. But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file.

Credit card and installment interest incurred for personal expenses. 50 of your cars use is for business and 50 is personal. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest.

This means that if you pay 1000 annually in interest on your car loan you can only claim a 500 deduction. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses.

Mortgage Affordability Tax Benefits Payoff Strategies Mortgage Mortgage Interest Rates Debt To Income Ratio

Pin By Si Skimo On New Offer Cash Out Refinance Loan Interest Rates Free Quotes

Insurance Insurance Tips Insurance Funny Life Insurance Agent Insurance Company Humor Life Best Cheap Car Insurance Auto Insurance Quotes Insurance Humor

Does The Interest On A Car Loan Reduce My Income Tax Liability Jerry

Is Car Loan Eligible For Tax Exemption Paysense Blog

Is Car Loan Interest Tax Deductible In The Uk

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable And Tenure Us Home Loans Loan Calculator Loan

Is Buying A Car Tax Deductible In 2022

Can I Write Off My Car Payment

Pin By Marissa On Budget 30 Year Mortgage Budgeting Notes Buy

10 Things You Should Never Deduct From Your Taxes All Time Lists Best Car Insurance Car Insurance Online Cheap Car Insurance

Lamborghini Gallardo With Custom Black Ag Form 210 Wheels Lamborghini Gallardo Avant Garde Wheels Lamborghini

Track These 5 Tax Deductible Items All Year If You Re An Employed Entrepreneur Or Self Emp Business Tax Deductions Tax Deductions Small Business Tax Deductions

Car Loan Tax Benefits And How To Claim It Icici Bank

Are Lender Credits Tax Deductible Fast Auto And Payday Loans Corporate Office Paydayloans Payday Loans Loan Lenders Easy Payday Loans

.jpg)