vermont sales tax food

In the state of Vermont they are exempt from any sales tax but are considered to be subject to the meals and rooms tax. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Sound Money Index Gold Silver Laws In 2020 Money Index Sound

For example if the tax you owe is 24443544 the tax is 2444355.

. 9741 13 with the exception of soft drinks. Vermont Sales and Use Tax Sales Tax. 974113 with the exception of soft drinks.

What is food tax in Vermont. Are groceries taxed in Vermont. An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale.

Meals and Rooms Tax Return. File Form SUT-451 Sales and Use Tax Return. The type of sales and amount of sales determine if a business is a restaurant.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Unless the context in which they occur requires otherwise. 9701 31 and 54.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. For more information on Vermont Sales and Use Tax and exemptions see Vermont law at 32 VSA Chapter 233 and Vermont regulation at Reg. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

What is sales tax on food in Vermont. A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law. An establishment that has made total sales of food or beverage in the previous taxable year of at least 80 taxable food and beverage.

Computing Vermonts retail sales tax of 6 percent. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. GENERAL PROVISIONS Cite as.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. What is the food sales tax in Vermont.

There are additional levels of sales tax at local jurisdictions too. Sellers should collect Vermont Sales Tax on TPP delivered to destinations. The Vermont Statutes Online Title 32.

It should be noted that any mandatory gratuities of up to 15 and all voluntary gratuities that are distributed to employees are not considered to be taxable. Round the tax to a whole cent. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. When making tax computations carry the decimal to the third place. Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific locations.

In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. 974113 with the exception.

Vermont Meals Tax Exemption Certificate for Purchases of Meals For Resale. Are groceries taxed in Vermont. This means that an individual in the state of Vermont purchases school supplies and books for their children.

If not round down to the nearest cent. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Application for Refund of VT Sales and Use Tax or Meals and Rooms Tax.

Taxation and Finance Chapter 233. SALES AND USE TAX Subchapter 001. Another example is food sold by a grocery store or market and which is intended for human consumption later off the premises of the seller.

It does not matter whether you are purchasing canned. If the third decimal is greater than four round up. The state-wide sales tax in Vermont is 6.

If you must pay sales and use tax for multiple locations or if your total sales and use tax remitted for the year will exceed 100000 the Commissioner of Taxes has mandated that you use myVTax. A new establishment that projects its total sales for the first year to be at least 80 taxable food and beverage Note. Sales tax is destination-based meaning the tax is applied based on the location where the buyer takes possession of the item or where it is delivered.

But there is endless justification of. 9701 9701. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0156 for a total of 6156 when combined with the state sales tax.

Effective July 1 2015 soft drinks are subject to Vermont tax under 32 VSA. If you have a single location and cannot file and pay through myVTax you may still use the paper forms. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. FOOD FOOD PRODUCTS AND BEVERAGES - TAXABLE. Vermont has a destination-based sales tax system so you have to pay.

PA-1 Special Power of Attorney for use by Individuals Businesses Estates and Trusts. Restaurant meals may also. Vermonts latest tax restructuring proposal addresses neither of these concerns -- it offers no substantive plans to fairly redistribute sales taxes on food.

A restaurant is defined as. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. The maximum local tax rate allowed by Vermont law is 1.

Vermont Bun Baker Cookstove Baker S Oven Tiny Wood Stove Wood Stove Cooking Wood Stove

Vermont Sales Tax Small Business Guide Truic

Home Of The Best Mustard Ever Stowe Mercantile New England

Experts Weigh In On Inflation Interest Rates The Economy Vermont Business Magazine

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Home Of The Best Mustard Ever Stowe Mercantile New England

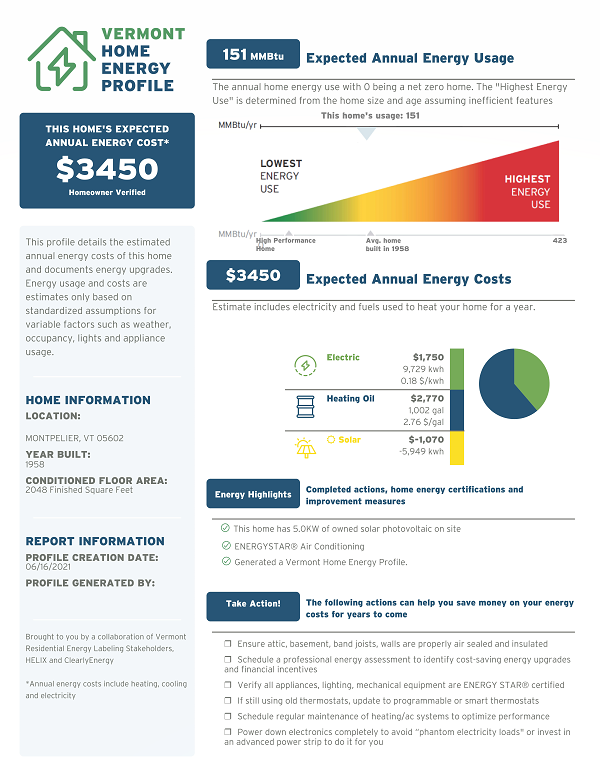

Home Energy Information Ordinance Net Zero Montpelier